The emerging trends in financial transactions and banking include digital banking, contactless payments, blockchain technology, and AI-driven analytics. These trends are reshaping the way people manage their finances and conduct transactions.

In today’s rapidly evolving financial landscape, digital banking has become increasingly popular, allowing customers to access their accounts, transfer funds, and make transactions from anywhere. Contactless payments, using methods such as mobile wallets and near-field communication (NFC) technology, have gained traction due to their convenience and safety.

Blockchain technology is revolutionizing security and transparency in financial transactions, while AI-driven analytics are enhancing personalized customer experiences and fraud detection. These emerging trends are driving innovation and efficiency in the financial industry, shaping the future of banking and transactions.

Digital Payment Innovations

Explore the latest trends in financial transactions and banking with the emergence of digital payment innovations. Experience a shift towards contactless payments, biometric authentication, and blockchain technology, revolutionizing the way we conduct monetary transactions. Stay ahead of the curve with these cutting-edge advancements in the financial industry.

As technology continues to advance, so does the way we handle our finances. Digital payment innovations have revolutionized the banking and financial industry, making transactions faster, more convenient, and secure. In this blog post, we will explore two emerging trends: Mobile Wallets and Contactless Payments.

Mobile Wallets

Mobile wallets have emerged as a popular digital payment solution, allowing users to store their credit card, debit card, and even loyalty card information securely on their smartphones. With just a few taps, users can make payments at point-of-sale terminals or online without the need to carry physical cards.

This technology utilizes near field communication (NFC) or QR codes to transmit payment credentials securely between the mobile device and the payment terminal. Users can easily manage their finances with features like transaction history, spending analysis, and even budgeting tools, all accessible within the mobile wallet application.

Mobile wallets offer convenience and security by incorporating biometric authentication methods like fingerprint or facial recognition, alongside traditional PIN or password authentication. This provides an additional layer of protection against unauthorized access and ensures that only the rightful owner can make transactions.

Contactless Payments

Contactless payments have gained momentum in recent years, especially with the widespread adoption of contactless-enabled cards and mobile wallets. These payments are made by simply tapping or waving a card or smartphone near the contactless-enabled terminal, without the need for physical contact or swiping.

This technology utilizes radio frequency identification (RFID) or NFC to enable secure and quick transactions. Contactless payments eliminate the hassle of digging for cash or inserting cards into payment terminals, making the checkout process faster and more efficient for both customers and merchants.

Not only do contactless payments provide convenience, but they also prioritize security. Each transaction generates a unique code that protects sensitive information from being exposed. Additionally, contactless payments have a maximum transaction limit, ensuring that even if a card or smartphone is misplaced, the potential loss is minimal.

Businesses are increasingly adopting contactless payment methods to cater to the changing consumer preferences. Whether it’s in-store purchases, public transportation fare, or even vending machines, contactless payments have become a preferred option due to their speed, simplicity, and safety.

As the world becomes more interconnected, it’s essential for financial transactions and banking to keep up with digital payment innovations like mobile wallets and contactless payments. These emerging trends not only offer convenience and security, but also enhance the overall customer experience, making managing finances easier and transactions faster.

Credit: www.linkedin.com

Blockchain Technology

Blockchain technology has revolutionized the way financial transactions and banking operations are conducted. It has introduced a decentralized approach to managing and recording transactions, ensuring transparency, security, and efficiency. One of the most notable trends in financial transactions and banking related to blockchain technology is the rise of cryptocurrency transactions, smart contracts, and the adoption of blockchain in traditional banking systems.

Cryptocurrency Transactions

Cryptocurrency transactions have emerged as a prominent trend in financial transactions and banking, leveraging blockchain technology to facilitate secure and transparent peer-to-peer transactions. Digital currencies such as Bitcoin, Ethereum, and Litecoin have gained considerable traction, offering individuals and businesses an alternative to traditional financial systems. The utilization of blockchain ensures that cryptocurrency transactions are immutable, making them resistant to fraud and tampering, while also providing rapid settlement and lower transaction fees.

Smart Contracts

Smart contracts represent another significant development in financial transactions and banking, enabled by blockchain technology. These self-executing contracts are programmed to automatically enforce and verify the terms of an agreement, without the need for intermediaries. Through the implementation of smart contracts, various financial processes can be streamlined, including loan origination, insurance claims, and trade settlements. The use of blockchain for smart contracts ensures transparency, accuracy, and immutability, enhancing the overall efficiency of financial transactions.

Artificial Intelligence In Banking

Artificial Intelligence (AI) is revolutionizing the banking sector, introducing innovative ways to enhance customer experiences and streamline operations. As financial institutions strive to stay competitive in a rapidly evolving landscape, AI has emerged as a critical tool for providing personalized services, managing risk, and optimizing operational efficiency.

Chatbots For Customer Service

Chatbots have become an integral part of customer service in the banking industry. They use AI to provide instant and personalized assistance to customers, addressing queries, resolving issues, and even processing transactions. These chatbots are available 24/7, ensuring round-the-clock support and improving customer satisfaction.

Risk Assessment

Risk assessment is a vital aspect of banking operations, and AI is increasingly being utilized to enhance this process. AI-powered algorithms can analyze vast amounts of data to detect patterns, identify potential risks, and predict future trends. This proactive approach helps banks mitigate risks effectively and make informed decisions to safeguard their assets and customers.

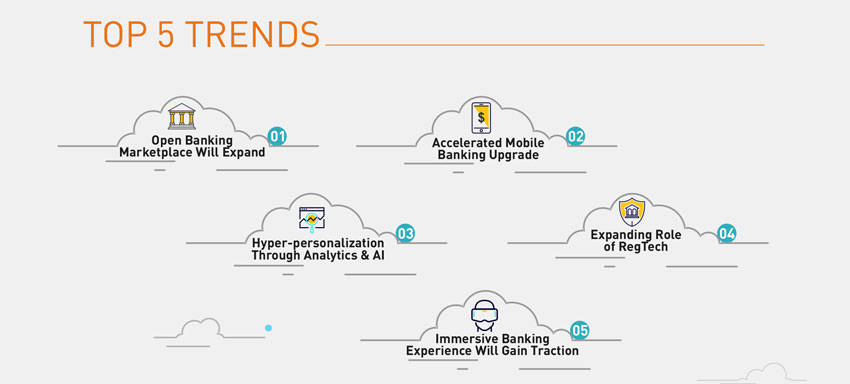

Open Banking Initiatives

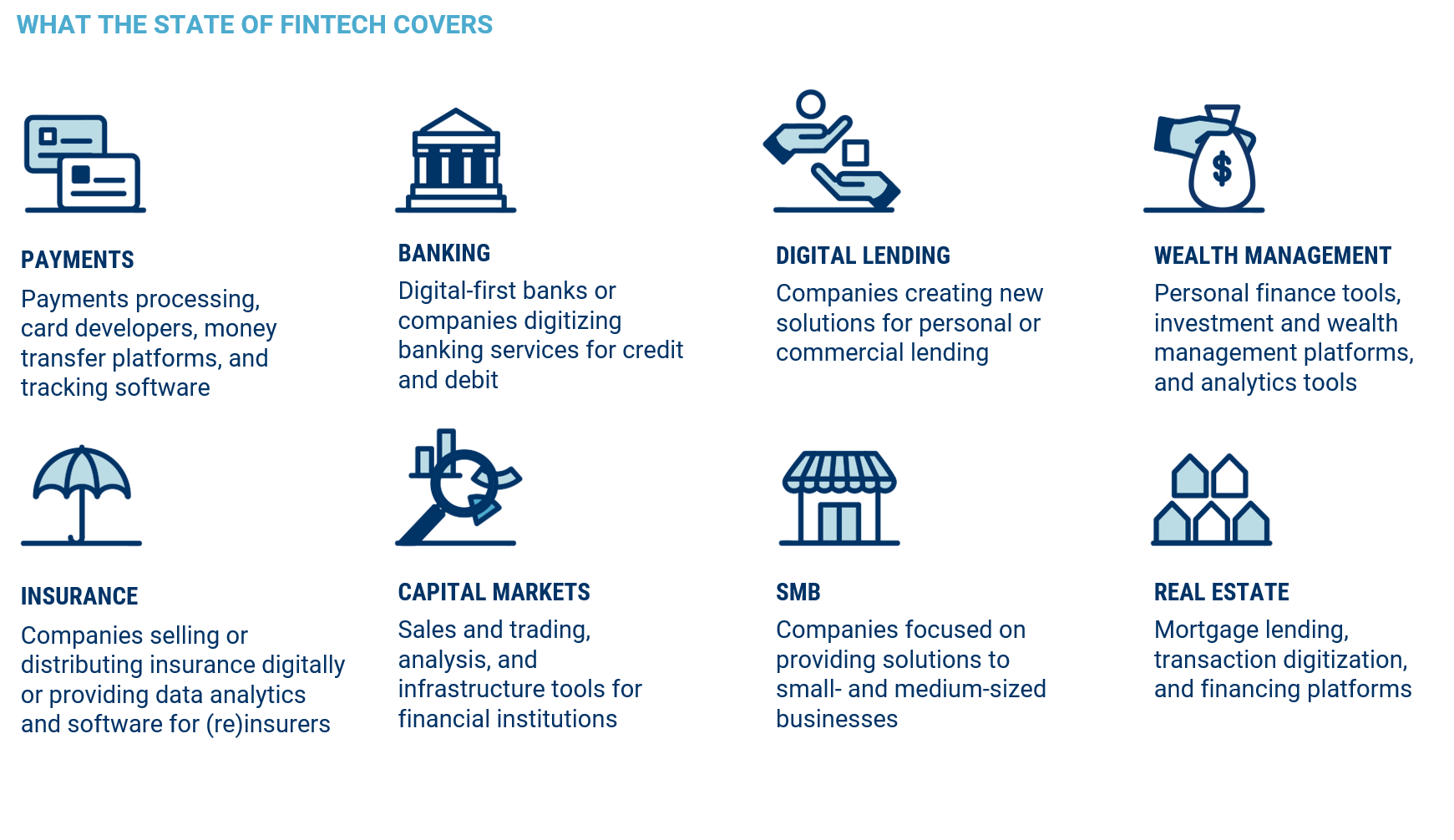

In recent years, the financial industry has witnessed significant advancements that are reshaping the way we conduct transactions and manage our finances. One such innovation is the concept of Open Banking Initiatives, which aims to revolutionize traditional banking systems by promoting collaboration and data sharing among financial institutions. These initiatives have given rise to a host of emerging trends that are transforming the landscape of financial transactions and banking. In this article, we will explore some of these trends, starting with the key aspect of Open Banking Initiatives.

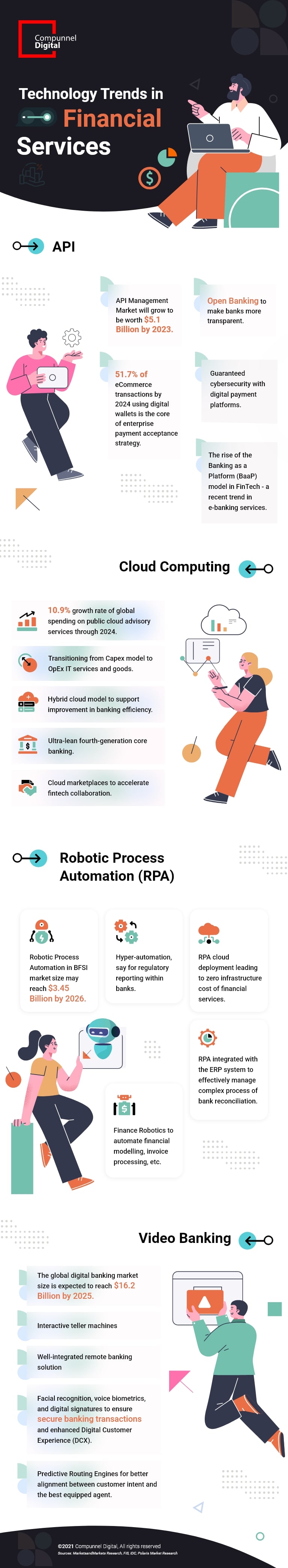

Api Integration

Banks have traditionally operated in closed ecosystems, limiting access to their customer data and services. However, with the advent of Open Banking, financial institutions are now opening up their systems through Application Programming Interfaces (APIs). APIs facilitate seamless integration between different organizations, enabling secure and efficient data transfer. This empowers customers with greater control over their financial data while fostering innovation through collaboration.

Third-party Service Providers

Open Banking has paved the way for the emergence of third-party service providers, also known as FinTech companies. These innovative startups leverage APIs to develop new and improved financial services that cater to specific customer needs. By partnering with banks and accessing customer data securely, these providers offer enhanced banking experiences, such as personalized financial advice and tailored product recommendations. This collaboration between traditional banks and FinTech firms drives competition, innovation, and ultimately benefits the end-users.

Cybersecurity Measures

Cybersecurity measures are crucial in the modern financial landscape to safeguard transactions and data.

Biometric Authentication

- Uses fingerprints or facial recognition.

- Provides a secure way to verify identities.

- Enhances protection against unauthorized access.

Fraud Detection Systems

- Utilizes advanced algorithms for real-time monitoring.

- Detects unusual activities in transactions.

- Prevents fraudulent attempts and protects user accounts.

Credit: www.wns.com

Sustainable Finance Practices

Sustainable finance practices are revolutionizing the banking sector, with a focus on responsible investments and ethical banking.

Green Investments

- Investing in environmentally friendly projects.

- Supporting renewable energy initiatives.

- Promoting sustainable practices in various industries.

Socially Responsible Banking

- Encouraging fair treatment of employees and communities.

- Empowering marginalized groups through financial inclusion.

- Prioritizing ethical lending practices.

Regulatory Changes Impacting Banking

Regulatory changes play a crucial role in shaping the landscape of financial transactions and banking. As the financial sector evolves, governments and regulatory bodies are implementing new policies and regulations to foster transparency, consumer protection, and technological innovation. In this article, we will delve into some of the emerging regulatory trends that are impacting the banking industry.

Gdpr Compliance

The General Data Protection Regulation (GDPR) has had a significant impact on the banking sector. This comprehensive regulation was introduced by the European Union to protect the personal data of individuals. Banks are now required to adhere to strict data protection measures, ensuring that customer information is collected, stored, and processed securely. Failure to comply with GDPR can lead to hefty fines and damage to the reputation of financial institutions. As a result, banks are investing in robust data privacy measures, conducting regular audits, and implementing encryption technologies to safeguard customer data.

Psd2 Regulations

The Second Payment Services Directive (PSD2) is another influential regulation that is transforming the way financial transactions are conducted. PSD2 aims to promote competition and encourage innovation in the banking industry. It requires banks to open up their customer data to third-party providers, enabling them to develop innovative financial services and applications. This means that customers now have the option to securely share their data with other trusted service providers, granting them access to personalized financial products and services. Additionally, PSD2 mandates the implementation of two-factor authentication for online transactions, reinforcing security protocols and reducing the risk of fraud.

Credit: www.compunnel.com

Frequently Asked Questions For What Are Some Emerging Trends In Financial Transactions And Banking

What Is The Next Big Thing In Banking?

The next big thing in banking is the rise of digital banking services, such as mobile banking apps, AI-powered chatbots, and blockchain technology. These innovations are revolutionizing the way people access and manage their finances, making banking more convenient and efficient for customers.

What Is The Hottest Trend In Banking Is The Use Of?

The hottest trend in banking is the use of digital technologies such as mobile banking apps and online payment platforms. These tools make it easier for customers to manage their finances and make transactions conveniently from their devices.

What Are The Trends Shaping The Future Of Banking?

Key trends shaping the future of banking include digital transformation, AI adoption, personalized customer experiences, cybersecurity advancements, and mobile banking innovations.

What Is Emerging Technology In Banking?

Emerging technology in banking refers to innovative tools and solutions transforming the industry. Common examples include AI, blockchain, and mobile payments.

What Are The Key Emerging Trends In Financial Transactions And Banking?

Innovations like blockchain, AI, contactless payments, and personalized services shape the future.

Conclusion

Emerging trends in financial transactions and banking are reshaping the way we handle our money. From contactless payments to digital wallets, the convenience and security of these innovations are revolutionizing the industry. With the rise of cryptocurrency and blockchain technology, we can expect even more transformative changes in the future.

It is crucial for financial institutions to stay updated and adapt to these trends to provide seamless and efficient services to their customers. Stay knowledgeable and open-minded to embrace the transformative power of these emerging trends in finance and banking.