You can find financial statements of private companies by accessing databases like PrivCo, PitchBook, or Bloomberg. These platforms provide comprehensive financial data and analysis for private companies, allowing you to access balance sheets, income statements, and cash flow statements.

Financial statements play a crucial role in understanding a company’s performance and financial health. They provide valuable insights for investors, creditors, and analysts, helping them make informed decisions. Accessing accurate and up-to-date financial statements is essential for evaluating a company’s profitability, liquidity, and solvency.

By leveraging specialized databases, individuals can gain access to critical financial information that is not readily available in the public domain. Understanding a company’s financial performance is imperative for making sound investment decisions, and accessing private company financial statements is a crucial step in this process.

1. Importance Of Financial Statements

Discover the significance of financial statements as they provide key insights into the financial health of private companies. While private company financial statements aren’t publicly available, they can be obtained through direct requests to the company, or by using specialized financial databases and research services.

Significance In Decision Making

Financial statements play a pivotal role in decision making processes for businesses and investors alike. These statements provide a comprehensive overview of the financial health and performance of a company, allowing stakeholders to make informed decisions. Whether you are considering investing in a private company or evaluating potential business partnerships, analyzing financial statements is crucial.Comparison With Public Companies

One of the advantages of financial statements for private companies is the ability to compare them with those of public companies. While public companies are subject to more stringent reporting requirements, private companies are not legally obligated to disclose their financial information. Therefore, gaining access to financial statements of private companies can be challenging. Nonetheless, the comparison of financial statements between these two types of companies can provide valuable insights.Adheres To Html Syntax

Credit: www.chegg.com

2. Challenges In Accessing Private Company Financial Statements

2. Challenges in Accessing Private Company Financial Statements

Lack Of Regulatory Requirements

Private companies are not obligated to disclose their financial information publicly, unlike publicly-traded companies. Regulatory bodies do not mandate private companies to file financial statements. This opacity makes it challenging to access comprehensive financial data. Without regulatory requirements, obtaining accurate and current financial information becomes a complex task.

Limited Availability

Private companies often strive to maintain confidentiality and privacy. As a result, they may not freely distribute their financial statements. This limited availability poses significant challenges for investors, analysts, and stakeholders who seek to gain insights into the company’s financial performance. With restricted access to financial data, making well-informed decisions becomes arduous.

3. Alternative Sources For Private Company Financial Data

3. Alternative Sources for Private Company Financial Data

Credit Rating Agencies

Credit rating agencies such as Moody’s, Standard & Poor’s, and Fitch Ratings offer valuable insights into the financial health of private companies. These agencies assess the risk associated with lending money to a specific company, providing detailed reports that include financial statements, credit ratings, and analyses. Accessing the reports from these agencies can provide a comprehensive picture of a private company’s financial standing.

Third-party Research Firms

Third-party research firms such as PrivCo, PitchBook, and S&P Capital IQ are dedicated to aggregating and analyzing financial data for private companies. These firms offer subscription-based services that provide access to comprehensive financial statements, industry analysis, and market trends. Utilizing these platforms can provide valuable insights for investors, analysts, and business professionals seeking private company financial data.

4. Subscription-based Financial Databases

For those seeking comprehensive financial information about private companies, subscription-based financial databases are an excellent resource. These platforms provide access to a vast collection of financial statements from various private companies, allowing users to explore and analyze data to make informed financial decisions.

Features And Limitations

Subscription-based financial databases come with a range of features that make them invaluable tools for researching private companies’ financial standing. Here are a few noteworthy features:

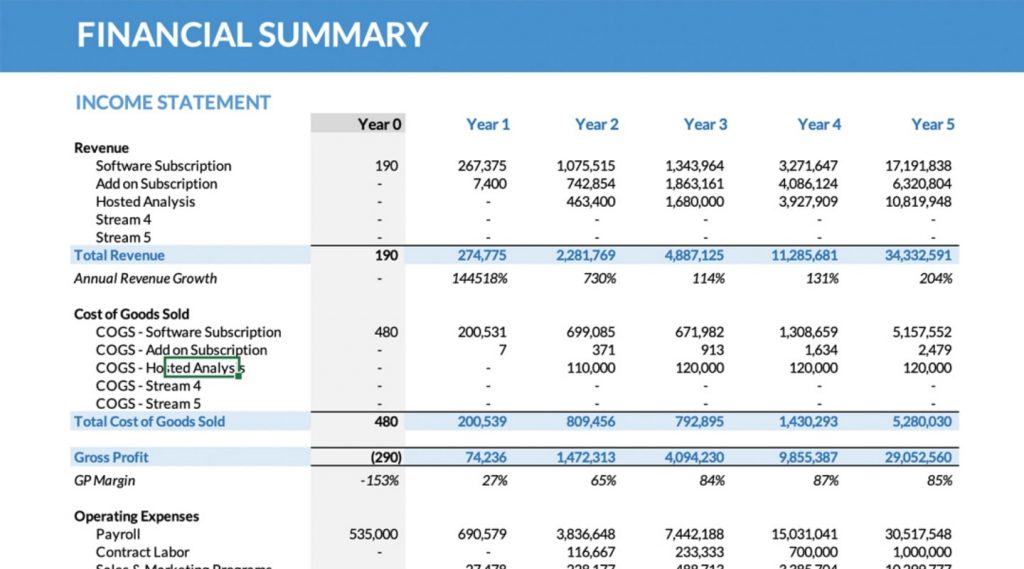

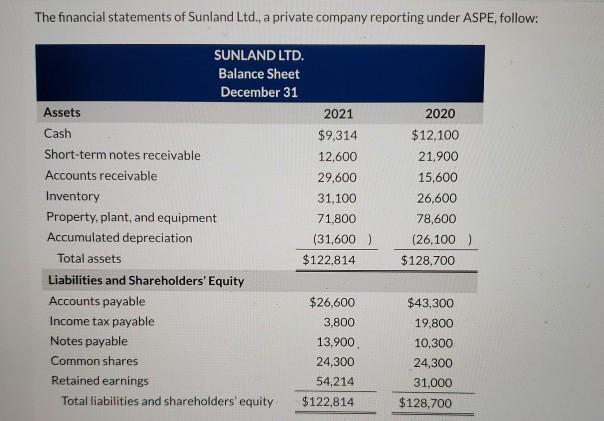

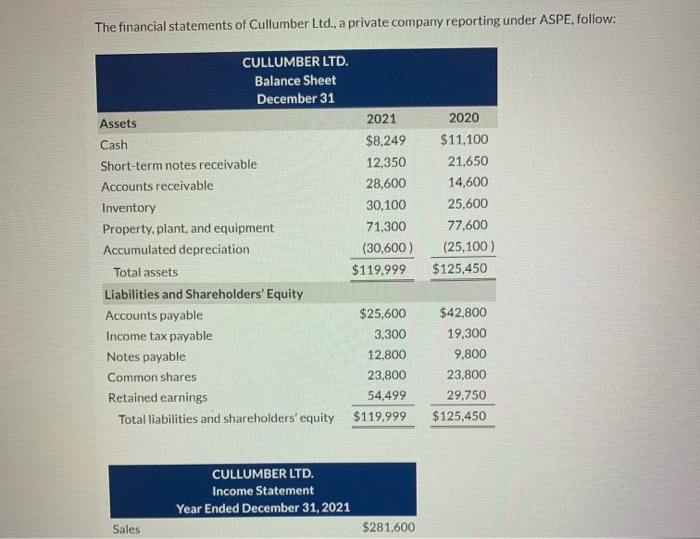

- Extensive Database: These platforms gather data from a wide range of sources, providing access to financial statements, balance sheets, income statements, and cash flow statements of numerous private companies.

- Advanced Search Functionality: Users can leverage advanced search filters to narrow down their search and find specific financial information within the database.

- Comparison Tools: These platforms often offer tools that allow users to compare the financial performances of multiple private companies, enabling them to identify trends, strengths, and weaknesses.

- Export and Download Options: Users can download financial statements in various formats to conduct further analysis or present the data to stakeholders.

However, it’s important to be aware of the limitations of subscription-based financial databases:

- Restricted Access: Access to these databases typically requires a subscription, which may involve a fee depending on the provider.

- Data Availability: While these databases offer a vast collection of financial information, it is worth noting that not all private companies may be included. Some smaller or less known companies may not have their financial statements available.

- Data Accuracy: Although efforts are made to ensure the accuracy of the financial data, inaccuracies or discrepancies may still exist. Therefore, it is advisable to cross-reference the information obtained from these databases with other reliable sources.

Cost Considerations

Subscription-based financial databases come at a cost, and the pricing structure may vary depending on the provider and the level of access required. Consider the following factors when evaluating the cost:

- Subscription Plans: Providers often offer different subscription plans with varying levels of access and features. Consider your research needs and budget to determine the most suitable plan for you.

- Additional Services: Some providers may offer additional services, such as financial analysis tools, industry reports, or personalized support. Assess these additional services and their relevance to your requirements.

- Value for Money: Evaluate the value you would derive from the database compared to the subscription cost. Consider factors such as the depth of information, the frequency of updates, and the overall usability of the platform.

By considering both the features and potential limitations along with the cost considerations, you can make an informed decision about whether subscription-based financial databases are the right resource for accessing financial statements of private companies.

5. Industry-specific Databases

When researching financial statements of private companies, industry-specific databases can be invaluable sources of information.

Focus On Niche Markets

Industry-specific databases provide detailed financial data on private companies operating in niche markets.

Availability Of In-depth Information

These databases offer comprehensive financial statements, market trends, and competitor analysis, enabling deep insights.

Credit: learnaccounting.wordpress.com

6. Establishing Direct Contact With Companies

When looking for financial statements of private companies, establishing direct contact with the companies can provide valuable insights. This method involves networking and direct communication.

Networking And Communication

Networking is a powerful tool to connect with private companies. Direct communication allows you to request financial information directly from the source.

Benefits And Challenges

- Benefits:

- Get access to exclusive financial data.

- Build relationships with the companies.

- Understand the context of the financial statements.

- Challenges:

- Companies may not disclose information easily.

- Time-consuming to establish connections with multiple companies.

- Difficulty in verifying the accuracy of the data provided.

7. Importance Of Interpreting Financial Statements Correctly

Understanding financial statements correctly is crucial for making informed decisions about private companies. You can obtain these statements from the company’s website, through financial databases, or by directly requesting them from the company’s management. Accurate interpretation of these documents is essential for assessing a company’s financial health and making investment decisions.

Potential Risks In Misinterpretation

Interpreting financial statements of private companies is crucial for making informed decisions regarding investments, partnerships, or vendor assessment.

- Incorrect interpretation can lead to potential risks and unfavorable outcomes.

- One potential risk is overestimating a company’s financial stability, which can lead to financial losses if the information is misleading.

- Another risk is underestimating a company’s financial performance, which might cause missed opportunities.

- Misinterpreting the financial statements can result in incorrect assessments of a company’s profitability, liquidity, or debt levels.

Misunderstanding financial ratios and trends can lead to faulty analysis and erroneous conclusions.

Seeking Professional Guidance

To mitigate the risks of misinterpretation, it is advisable to seek professional guidance in examining financial statements.

Benefits of Seeking Professional Help:

|

As financial statements are a fundamental tool for assessing a company’s health and performance, skilled professionals play a pivotal role in accurate interpretation.

By engaging the services of financial analysts, accountants, or consultants, individuals and businesses can gain a comprehensive understanding of the financial statements, enabling well-informed decision-making.

Credit: www.chegg.com

Frequently Asked Questions For Where Can I Find Financial Statements Of Private Companies

Can You Find Financial Statements For Private Companies?

Yes, it is possible to find financial statements for private companies.

How Do I Get Financial Data From A Private Limited Company?

To get financial data from a private limited company, request access from the company directly. Privacy laws may apply.

Who May Access The Financial Statements Of A Private Company?

Authorized stakeholders like shareholders, investors, and creditors may access the financial statements of a private company.

How Do I Find Information On A Privately Held Company?

To find information on a privately held company, research their website, annual reports, press releases, and news articles. Check business directories, databases like Bloomberg, Hoovers, or PitchBook, and conduct online searches using keywords like company name, industry, location, and key personnel.

Where Can I Access Financial Statements Of Private Companies?

To access financial statements of private companies, check with the SEC, corporate websites, and financial databases.

Conclusion

Whether you’re an investor, analyst, or entrepreneur, accessing accurate financial statements of private companies is crucial for informed decision-making. Fortunately, there are several avenues you can explore to find these financial statements. From using government databases and industry-specific platforms to reaching out directly to the companies themselves, these methods provide valuable insights into a company’s financial health and performance.

By leveraging these resources, you will be better equipped to evaluate opportunities and mitigate risks in the complex world of private company finance.